Posted 6/28/2023

After a three-year pause, student loan payments will resume in 2023. Unfortunately, borrowers aren’t financially prepared for their return. Even worse, the student loan support system is too small to handle their numbers. With tens of millions ready to enter the system, we’re facing what could be an unprecedented repayment crisis.

Today’s borrower is living in a time of economic turmoil. Inflation is higher than any point since 1990, and wages have not caught up. Hikes on the Fed Funds Rate have driven up the cost of consumer debt on car loans and credit cards. The result is budgets squeezed between higher costs and higher minimum debt payments.

The rising number of consumer credit delinquencies indicates borrowers’ budgets are starting to crack. Many will shatter once student loan payments resume.

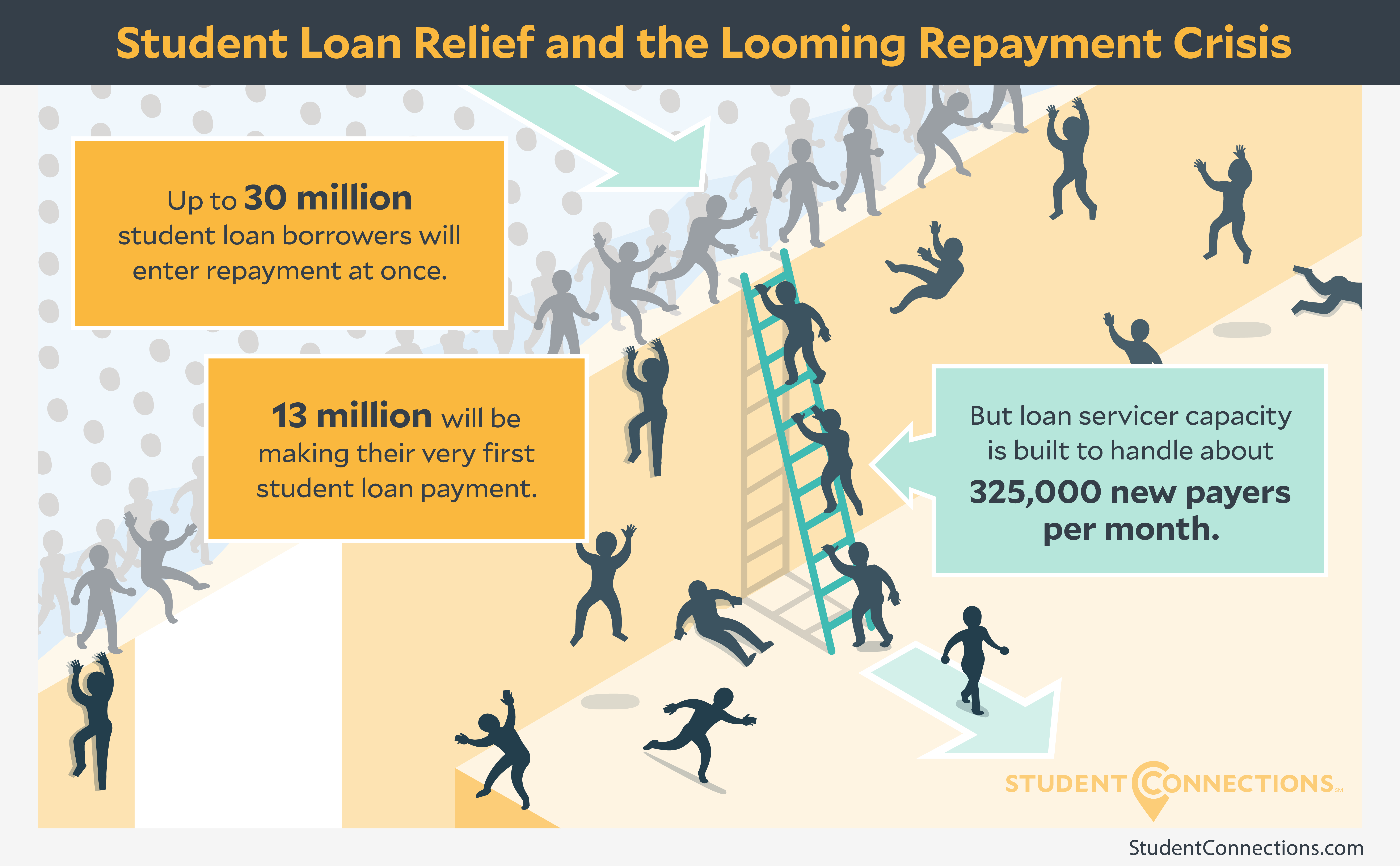

The student loan support system was designed to accommodate about 325,000 new borrowers per month. When the payment pause ends, it will be flooded by more than 30 million. If the Supreme Court rules in favor of student loan debt relief, that number would drop to 20 million. Whatever their decision, servicers will be overwhelmed.

Instead of beefing up support, call centers are actually shrinking. The Department of Education (ED) recently reduced how much loan servicers are paid per borrower which has led to layoffs. ED also lowered the required minimum hours of operation and service levels.

When repayment starts, millions of borrowers will need help. Unfortunately, connecting with someone who can assist them will require a miracle. Sheer numbers will clog the traditional channels of support.

What will borrowers do if they can’t afford their loan payment and can’t get help? For many the choice could be paying the rent or paying their debt. Without proactive action from a trusted source, millions will fall into delinquency and start the slide towards default.