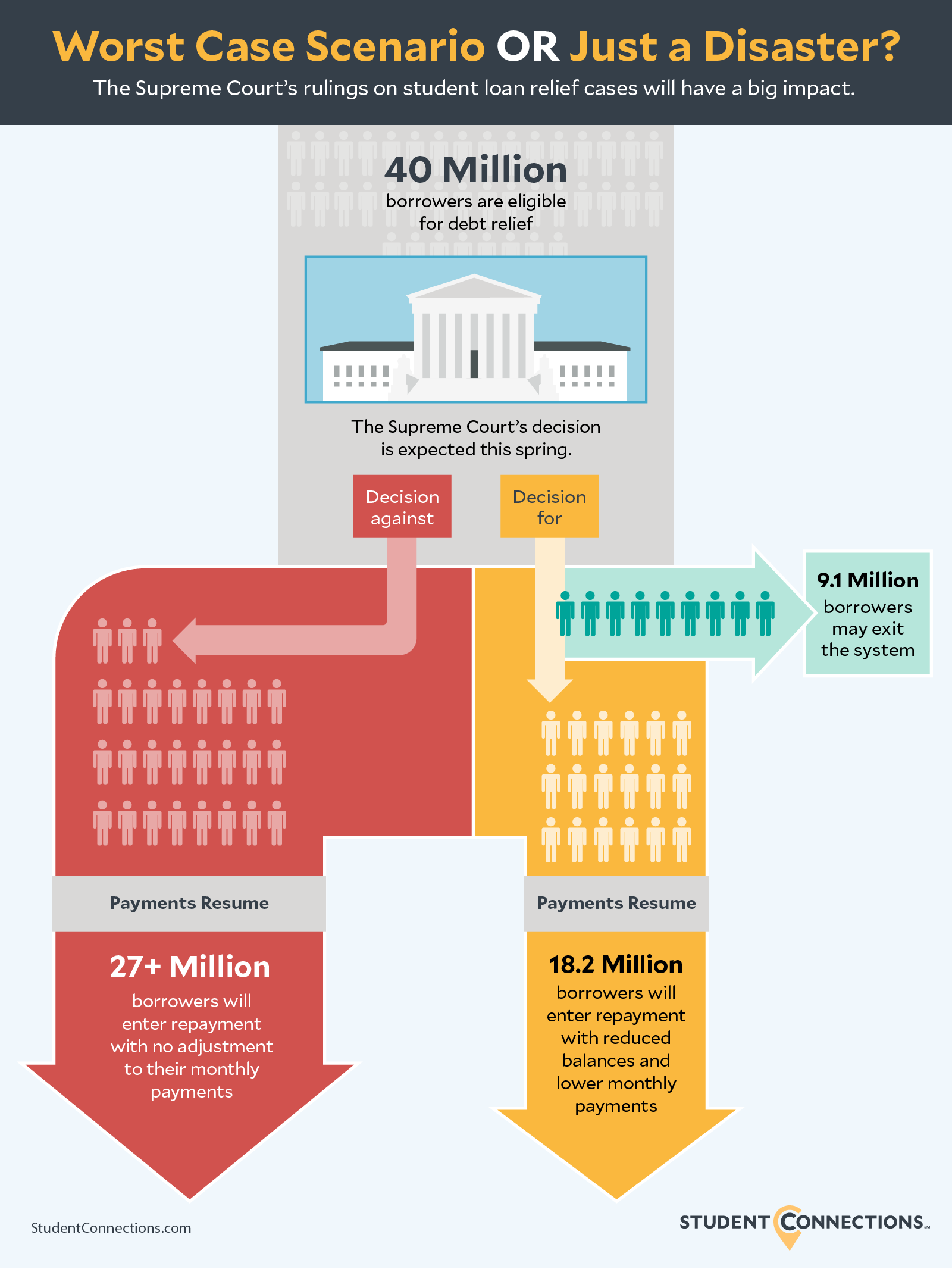

Overwhelming numbers of borrowers will resume student loan payments in 2023. This is likely to trigger a repayment crisis. The scale of the crisis hangs on the Supreme Court’s ruling on the Biden-Harris Administration Student Loan Debt Relief program.

The Supreme Court’s ruling on the Biden-Harris Administration Student Loan Debt Relief program will not cause the repayment crisis. However, it will determine the magnitude of the problem.

A ruling against debt relief provides the worst case scenario: Over 27 million borrowers will enter repayment 60 days after the ruling. We suspect a large percentage will be unable (or just choose not) to make their monthly payments.

If the program is allowed to move forward, more than 40 million borrowers will be eligible for some relief, with nearly one-third of all borrowers having their accounts completely paid off. That reduces both the number of borrowers resuming payments and the monthly payment for those that have a balance remaining.

The systems supporting federal student loans weren’t designed for repayment to entirely stop and restart after more than three years. Everything from the process to the technology supporting it were created to support a steady stream of borrowers as they exited school. But the resumption of payments will flood those systems with up to 36 times the number of students they were built to support in a month.

What’s worse is that today’s borrowers are much more financially fragile than before the student loan payment pause. Another large monthly payment could wreck their personal budgets. When struggling borrowers reach out to their loan servicer for help through traditional channels, the overwhelming majority won’t get through. Left with few options, many will slip into delinquency.

Take care of your former students by teaming-up with a trusted partner. Student Connections can strategize and execute a customized, multi-channel campaign designed to inform and counsel them through the coming repayment crisis.

We currently represent more than 300 schools, and support over 8 million borrowers across the United States. Using a combination of phone calls, emails, and text messages, we connect former students to information they need to succeed.

We also take time to personally counsel borrowers who have questions or want a better understanding of their options. Our experienced borrower advocates have advised over 700,000 borrowers throughout the payment pause.

If you want help preparing for the repayment crisis, contact Student Connections today.